Credit Union vs. Bank: What’s the Difference and Why It Matters for You

Friday, Oct 10 2025

Thinking about where to stash your cash? When opening a checking or savings account, taking out a loan, or seeking a line of credit, it’s not just about picking a place. It’s about choosing what works for you.

An often-overlooked option is a credit union, which offers many of the same financial products and services as a bank. But what’s the difference between a credit union vs. a bank?

Understanding the distinctions between these financial institutions can help you make an informed decision for your financial needs.

In this post, we break down the difference between a credit union vs. bank so you can make the right decision for your financial goals.

What Is a Credit Union?

Credit unions are not-for-profit organizations operating on the philosophy of “people helping people.” More than 142 million Americans belong to a credit union.

At first glance, credit unions appear like typical banks, offering many of the same financial products. Members can access the same products and services a bank provides, such as credit cards, checking and savings accounts, and loans. But a closer look shows how banks and credit unions operate differently.

To join a credit union, you usually need to meet criteria such as belonging to a certain labor union, employer, or school, or being a family member of an existing member.

What Is a Bank?

Banks are for-profit institutions owned by investors and obligated to deliver a profit to their shareholders. They range from small, community-based institutions to large, nationwide entities.

Though much banking now occurs online, banks often have a national or even global presence.

Banks offer checking and savings accounts, loan and mortgage services, automobile financing, and a range of other financial services. Their primary source of revenue is loan interest. Unlike credit unions, banks are typically open to the public and function to generate profits.

Credit Union v. Bank: Key Differences at a Glance

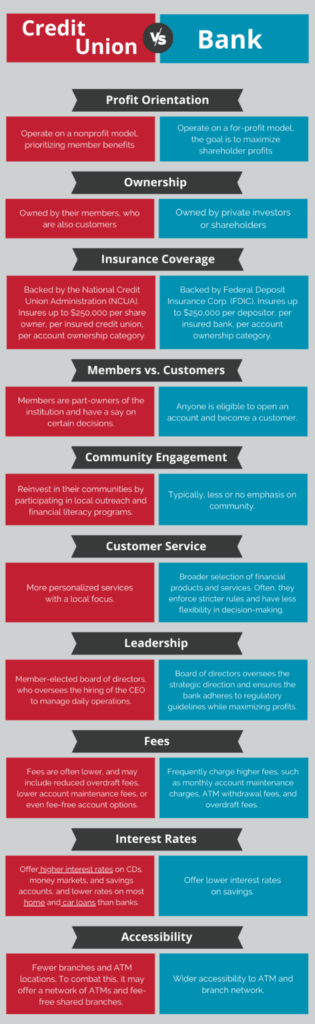

Banks and credit unions are both institutions that hold cash and give you standard financial services. The most significant difference between credit unions vs. banks is their profit status.

Banks are for-profit institutions, meaning they are privately owned or publicly traded. Credit unions are nonprofit financial institutions owned solely by their members.

The for-profit vs. not-for-profit divide impacts each type of institution’s products and services.

Credit unions charge interest and fees like banks, but reinvest those profits back into their products and services. In contrast, banks distribute these profits to their shareholders. And as nonprofits, credit unions are generally exempt from federal taxes.

Let’s look at the differences between a credit union vs. bank.

FAQs: Credit Union vs. Bank

Here are some common questions people have about credit unions vs. banks.

Are Credit Unions FDIC-Insured?

Different entities insure credit unions and banks. Bank deposits are insured by the Federal Deposit Insurance Corporation (FDIC). The standard level of protection for individual, joint, and retirement accounts is up to $250,000 per depositor per insured bank. Credit unions are regulated by the National Credit Union Administration (NCUA), which provides deposit insurance similar to that of the FDIC.

Can I Join a Credit Union If I Don’t Work for the Company?

Credit unions differ from banks in that they serve specific groups of people based on a defined field of membership. This means you must meet specific criteria to become a member.

Some credit unions have membership requirements, such as where you live or work, employer or industry affiliation, education or military affiliation, or membership through an association or causes that you’re involved with.

What Does It Mean To Be a “Member” of a Credit Union?

Credit unions operate with a member-based governing structure. Members receive one vote regardless of the size of their deposits. Credit union members elect a board to carry out governance. The member-elected volunteer board of directors manages credit unions.

Some credit unions have specific membership requirements, such as those based on military service or company affiliation. Even if you don’t qualify for those, there are still about 4,400 federally insured credit unions with more than 142 million members. There’s a good chance you’ll be able to find one that you can join.

Can I Use My Credit Union If I Travel Often?

Certain credit unions are part of the CO-OP Shared Branch network, which enables members to fulfill their banking needs, regardless of their location.

Credit union members can perform transactions at other participating credit unions just as they would at their usual one, with the same level of service and convenience.

To access your account, you’ll need the name of your credit union, your account number, and a government-issued ID. At any CO-OP Shared Branch, members can transfer and deposit funds, make withdrawals, and balance inquiries, and have access to surcharge-free ATMs.

To find a CO-OP shared branch or ATM:

- Use the CO-Op locator,

- Download the CO-OP locator app for Apple or Android,

- Call 1.888.SITE-CO-OP, or

- Text your Zip Code to 91989.

Do Credit Unions Have Mobile Apps?

Yes, credit unions have mobile apps for Apple and Android. These apps offer members convenient, on-the-go access to member accounts, enabling them to check balances, transfer funds, pay bills, and utilize features such as mobile check deposit and money transfers.

With The Focus Federal Credit Union app, check your account details at any time. You can also monitor account transactions, no matter where you are.

The Focus Federal Credit Union app provides:

- 24/7 Accessibility. Mobile banking breaks down the barriers of time and location. Banking fits into your busy schedule, so you don’t have to worry about making it to a branch before it closes or finding an ATM.

- Real-Time Account Management. Update your account preferences and profile information, view your balance, pay bills, lock or unlock your credit cards, transfer funds between accounts, or check on pending transactions in real-time.

- Check Deposit. Focus app uses remote deposit capture technology, making depositing checks and managing your checking account safe and secure.

- Customizable Alerts and Notifications. With the Focus app, you’ll never have to worry about missing a payment or overlooking fraudulent charges in your account. You can set up alerts to notify you of account activity, ensuring you can quickly address suspicious transactions.

How to Switch From a Bank to a Credit Union

Switching to a credit union doesn’t have to be a hassle. To join, verify you meet the membership criteria. Apply online or in person at the bank.

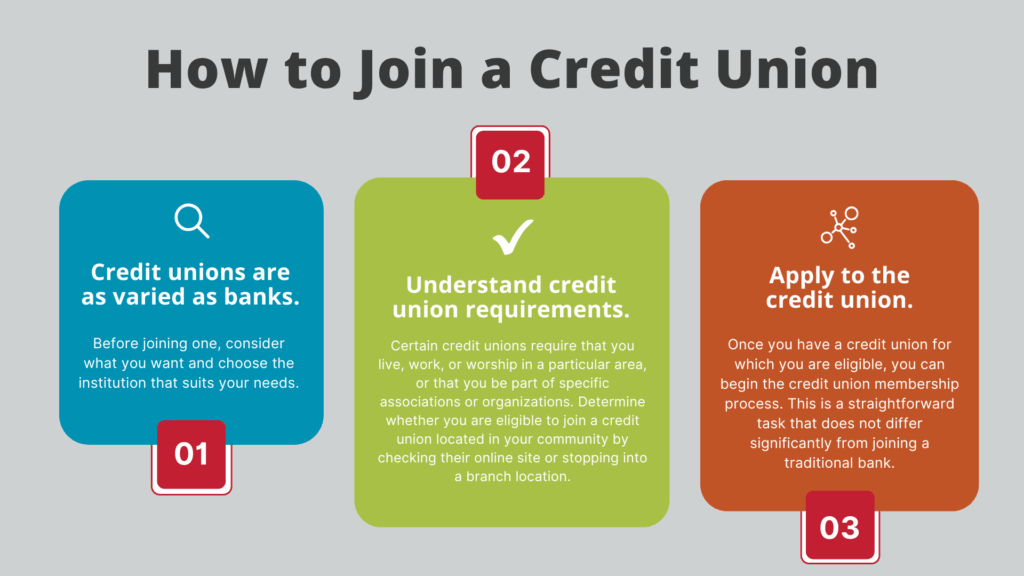

Steps to join a credit union:

- Step 1: Credit unions are as varied as banks. Before joining one, consider what you want and choose the institution that suits your needs.

- Step 2: Understand credit union requirements. Certain credit unions require that you live, work, or worship in a particular area, or that you be part of specific associations or organizations. Determine whether you are eligible to join a credit union located in your community by checking their online site or stopping into a branch location. We would love to have you at TFFCU if you live, work, worship, or attend school within our seven counties: Oklahoma, Cleveland, Canadian, Lincoln, Logan, McClain, and Grady.

- Step 3: Apply to the credit union. Once you have a credit union for which you are eligible, you can begin the credit union membership process. This is a straightforward task that does not differ significantly from joining a traditional bank.

To join, you’ll need:

- Two forms of identification. A driver’s license, passport, birth certificate, or vehicle registration is acceptable.

- Your Social Security Number or your individual taxpayer ID number.

- Bank routing numbers and account information, or a debit card.

- Personal information, including your address, phone number, and, of course, your name.

- Step 4: Deposit into your new account. Once your application is approved, your membership begins. Note, certain accounts require a minimum to open or avoid fees.

- Step 5: Switch automatic deposits and auto-pay activity. Once the deposit is made, you will need to transfer all your automatic transactions to your new credit union account. Verify payments are being deposited into your new account, such as utility and streaming services. Allow at least one billing cycle for these payments so you can confirm that the new payment information is posted correctly. Once you’ve transferred your finances and bills are changed, close your old account.

Ready to Make the Switch?

Understanding the differences between banks and credit unions can help you choose what aligns with your financial goals.

If you live in Oklahoma, Cleveland, Canadian, Lincoln, Logan, McClain, or Grady county and are looking for lower rates and fees, a personal touch, and access to free financial education, contact Focus Federal Credit Union.