We offer several credit card options in order to support our members with their financial needs. Use your Focus MasterCard for everyday expenses, larger purchases, or annual expenses like trips and vacations. Our financial counselors can work through the benefits and terms of each card with you and help you make a selection that best fits your lifestyle. Our MasterCard’s feature:

- Low fixed rates

- 25-day grace period on purchases

- Online access to your credit card account

- 24-hour fraud monitoring

- Worldwide access

- No transaction fees for purchases

- No over-limit fees

- No annual fees

- No cash advance fees

- No balance transfer fees

- Rewards Program

For complete information, you may download our MasterCard Account Agreement.

Focus MasterCard Benefits

- View your transactions through your mobile banking without logging into another 3rd party website.

- Current balance info is updated faster than before.

- Request a cash advance through your mobile banking instead of visiting a branch or ATM (for HELOC, Classic, and Platinum cards only).

- Only dealing with the credit union for maintenance questions on your card.

- A faster, more convenient way to verify possible fraudulent transactions.

- New designs to match the type of card you have.

- Set up autopay directly through the credit union.

- New Rewards Program.

- Access to your statements via online banking.

FAQ’s

- How can you view transactions?

- View transactions on home banking just like for your savings and checking accounts.

- How long does it take to see payments post?

- Balances should update as soon as the payments post to the card.

- Who do I call for customer service?

- US! You will no longer have to call a third-party phone number.

- What happens if I have fraud on my card?

- Call us to file a dispute.

- Automated text messages will alert you to suspicious transactions for review. You can approve the transaction or block it with a text response.

- Can I set up autopay?

- Yes! You can set up autopay through your Focus account or an External financial institution.

- How do I place a travel notification?

- Call us and we will do it for you.

- Can I report my card lost/stolen after hours, and if so, how?

- Yes, just like your debit card, if you go to the card management tab under home banking, you can select to turn off the card until you can talk with someone. You can also block your card by calling 888-297-3416.

- Where will payments be mailed to?

- All check payments will need to be mailed to the Main branch location.

- Can I make payments online?

- Yes, you have the option to transfer your payment through home banking, just like you would transfer between checking and savings. Simply select the account to transfer from and select the MC to transfer to. Also, there is a link on our website for members who want to pay using other institutions.

- What new perks will I have now?

- If you are Classic and Platinum cardholders, then we are now offering rewards. You can manage those rewards under the home banking link titled “Card Rewards”. This does not apply to Shared Secured or HELOC’s.

- How can I set my PIN?

- When you call to activate your card, you can set a PIN in the same phone call. You can also call us to set a PIN if needed.

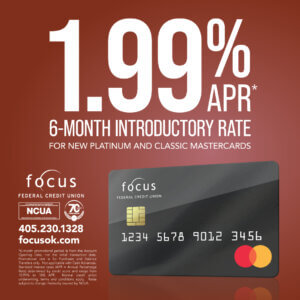

MasterCard Classic

as low as:

12.99% - 17.99% APR

MasterCard Platinum

as low as:

10.99% - 17.99% APR

MasterCard Secured

as low as:

13.99% APR

Questions about your billing statement? Need to report a lost or stolen credit card?

We’ve got you covered.

PHONE ASSISTANCE

Customer Service: 405.230.1328

Card Activation: 1.800.290.7893/International: 1.206.624.7998

Lost/Stolen: 1.888.297.3416/International calls: 1.206.389.5200

MAIL YOUR PAYMENT

Credit card payments can be mailed to

Focus FCU

420 NE 10th Street

Oklahoma City, OK 73104