What Is a Perfect Credit Score?

Friday, Oct 3 2025

Have you ever wondered what a perfect credit score is? Your credit score is a number based on the information in your credit reports, measuring how “risky” you are as a borrower. In other words, it tells lenders how likely you’ll be to pay back your debt.

Perfect credit, or even really good credit, opens financial doors. You may receive lower interest rates on loans, have better odds of renting an apartment, or even have access to lower insurance premiums. But how do you get there?

In this post, we break down what goes into calculating your credit score, ways to improve your score, and why a good score is essential.

What Is a Perfect Credit Score?

A credit score is an evaluation of your credit risk at a given point in time. It can help lenders determine whether loaning you money is a wise investment.

Credit scores can range from 300 to 850. A score of 850 is considered a perfect score. About 1.76% of Americans have a perfect score, according to Experian data. But more than 21% of consumers have scores of 800 or higher, which is still really good, according to the same source.

What Are Credit Score Ranges?

Your credit information is stored by credit-reporting agencies, also called credit bureaus. These bureaus receive information and weigh factors to create credit scoring models predicting the likelihood that a borrower will pay back debt.

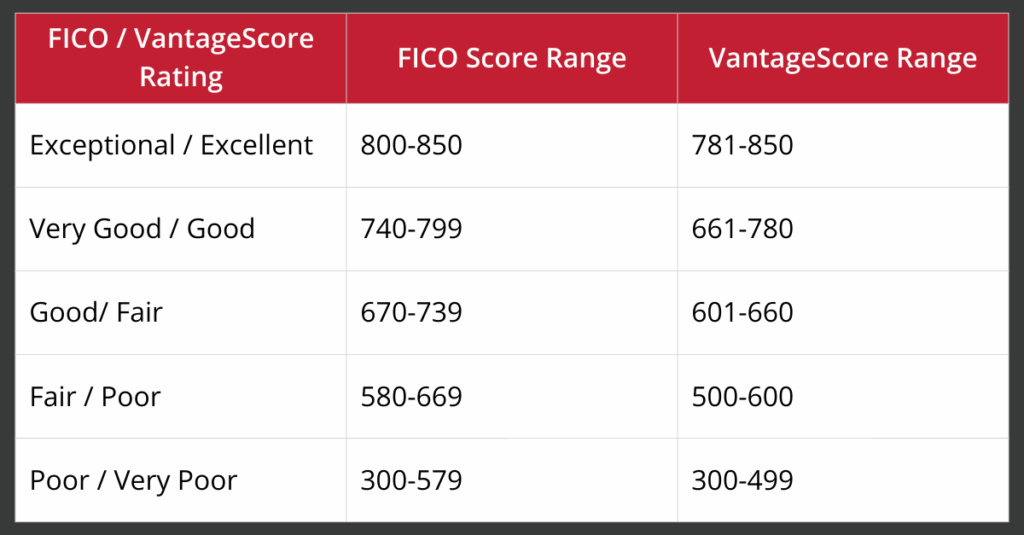

FICO® and VantageScore® produce most credit scores. And while both try to predict the same thing, their scoring models use slightly different criteria to determine your scores.

Since both FICO and VantageScore credit scores serve the same purpose, it shouldn’t be surprising that they share several features, with a few minor differences. For FICO® to create a credit score, you’ll need to have a credit account that’s at least six months old and have activity on the account during the prior six months.

You may be scoreable by VantageScore if your credit report has at least one account in it, even if the account is less than six months old.

VantageScore originally had different scoring ranges, but has adopted the same 300 to 850 scale FICO uses. But the way lenders interpret the scores may not be identical, meaning a good credit score can vary from lender to lender. It may also differ based on the credit score brand.

For example, a 670 FICO Score might be high enough to qualify for a loan at one bank, but you might need a 680 VantageScore credit score for another lender to approve your application.

The chart below is a general guide to show how your FICO Score or VantageScore credit score might rank.

What Factors Affect Your Credit Score?

The specific calculation of credit scores varies among credit bureaus. Each bureau uses a proprietary scoring model to assess creditworthiness. They periodically update their models to ensure accuracy and relevance. And while the exact formulas are not disclosed, your score is developed from five weighted categories of information.

The five factors affecting your credit score are:

- Payment history

- The amount of debt you owe

- How long you’ve been using credit

- New or recent credit

- The types of credit used

Each factor is weighed differently in your score. FICO and VantageScore do not consider factors such as where you live, income and employment, demographics, and beliefs.

Let’s take a closer look at the factors that make up your credit score and how the model calculates your score:

- Payment History (35% of FICO® score, 41% of VantageScore). The single most significant factor determining your credit score is whether you pay current and past bills on time. Making on-time payments on your credit accounts can help your scores. Late or missing payments, delinquent accounts, and debt in collections all hurt your scores. Automate payments to avoid accidentally slipping up and missing a due date.

- Credit Utilization (30% of your FICO® score, 20% of VantageScore). Creditors want to know if you’re spreading your financial self too thin. Your credit utilization rate compares the balances and credit limits of revolving accounts. Credit utilization involves examining the number of accounts with balances and the total amount owed. Excellent credit scores have a utilization rate in single digits. To lower your credit utilization, pay down existing balances. Aim for a credit utilization rate under 10%.

- Length of Credit History (15% of your FICO® score, 20% of VantageScore). This measure considers various time-related factors, including the length of your accounts, their average age, and the ages of your oldest and newest accounts. A long credit history can positively affect your credit, whereas a short credit history can negatively impact your score.

- New Credit Inquiries (10% of your FICO® score, 11% of VantageScore). New credit looks at any accounts you have recently opened and credit inquiries. Specifically, looking at credit inquiries within the past 12 months. Getting your score through your bank or a free credit score service does not affect your score.

- Credit Mix (10% of your FICO® score). Credit mix considers whether you’re managing both installment accounts, like car loans, personal loans, or mortgages, and revolving accounts, like credit cards and credit lines. Showing you can manage both types of accounts responsibly generally helps your scores. VantageScore takes a slightly different angle, looking at your available credit and balances, making up 8% of your VantageScore.

How Do You Get a Perfect Credit Score – or at Least Closer?

Since your credit score is a mix of multiple factors, it takes a variety of behaviors to increase your score, including:

- Check Your Credit Report. One in five consumers has a mistake on their credit report. Review credit reports for inaccuracies or fraudulent accounts. You can pull your credit report at no charge once a year from each of the three bureaus. You have the right to dispute errors and have the creditor or credit bureau investigate. If you notice an error, you’ll want to follow the process for dispute resolution.

- Have Accounts in Good Standing. The more accounts you have in good standing, the better. If you’re not able to open a regular credit card, open a secured account. Secured credit cards are easier to get because they require a security deposit.

- Build Your Credit History. Lenders want to see a history of responsible money management. Access to credit and a long credit history boost your overall credit score. Keep accounts open, even if you’re no longer using them. Closing credit card accounts will reduce your access to credit, raise your credit utilization ratio, and give the impression that you have little credit experience. One exception is if you have a credit card that charges an annual fee to keep the account open, even if you aren’t using it. Close any accounts that are costing you money.

- Don’t Apply for Too Much Credit. Retailers frequently offer special deals for opening a credit card account. Be cautious not to apply for too many. Each time you apply for a credit card or loan, an inquiry appears on your credit report and temporarily reduces your credit score. Limit applications to avoid these drops.

- Lower Your Credit Usage Rate. Credit utilization is a ratio that measures your monthly credit card balance in relation to your total available credit. Work to keep your credit utilization ratio below 30%. A ratio of less than 10% percent positively impacts your score.

- Pay Bills on Time. It sounds simple enough, but it is easy to forget to make your payment on time. If you struggle to remember when bills are due, consider setting up accounts to withdraw your monthly payments from your bank automatically.

- Make At Least Your Minimum Payment. While we recommend paying your bill in full every month, sometimes that can’t happen. You should always make at least your minimum payment. Even a single payment that’s 30 days past due can hurt your credit scores. Late payments remain on your credit report for up to seven years. If you think you will miss a payment, reach out to your lender as quickly as possible to see if they can work with you and help you stay in good standing.

Why Do Credit Scores Matter?

Your credit score influences many aspects of your financial life. Above all, it can determine your eligibility for credit cards, car loans, home loans, apartment rentals, and even specific jobs. A good credit score can help open more financial opportunities.

Generally, a good credit score can give you better odds of approval on loans and help you secure better loan terms, like lower interest rates. For larger, longer-term loans, like mortgages and auto loans, it can help save a significant amount of money.

Having a higher credit score offers you benefits, including:

- Access to Lower Interest Rates. The higher your credit score, the more likely you are to have access to lower interest rates. You may qualify for competitive offers from various lenders, whether you need a mortgage, car loan, or personal loan. Lower interest rates translate to a lower cost of borrowing. It will also save you money over time since you won’t be paying as much in interest.

- Higher Loan Amounts and Credit Limits. If you have a high credit score, lenders see you as less risky, so they are more likely to lend you larger amounts of money compared to borrowers with poor credit.

- Lower Insurance Premiums. Credit scores are factored into your insurance rates. If you have a higher credit score, you are more likely to pay lower premiums on your car or home insurance because higher credit scores are associated with lower filed claims. Insurance companies view lower credit scores as indicating a higher risk of filing claims.

Financing With TFFCU

If you plan to take out any financing, your credit score can impact how much you pay. A perfect credit score of 850 is difficult to get, but an excellent credit score is more achievable.

Looking to learn more about your credit score and interest rates? The team at Focus Federal Credit Union is here to help walk you through what you need to know to rebuild or establish credit. Contact us today.