Why You Should Be A Member At Focus Federal Credit Union

Friday, Jul 17 2020

Focus Federal Credit Union is a non-profit organization. This designation means we get to prioritize our members instead of focusing on profit margins. With over 65 years of experience in customer satisfaction and financial service, we have the prowess and the technology to solve any financial situation. We want to see our members and the surrounding community thrive. That’s why when you are a member at Focus Federal Credit union you are treated like family.

We think you should consider Focus Federal as your primary banking center and there are many reasons why.

Benefits of Being a Member Focus Credit Union

After becoming part of Focus Federal Credit Union, new members get to take advantage of benefits immediately. First, you get to take advantage of traditional perks like a debit card, remote deposit, and automatic bill pay. Along with checking and savings accounts that fit a variety of needs, there are accounts for students, to save for future expenses, for a second chance, and for members who prefer a reloadable card over a bank account. You can use one of our convenient locations for in-person services, bank online, and bank on your phone. There are also thousands of surcharge-free ATMs around the country when you leave Oklahoma.

The next perks are what really makes membership at Focus Federal unique to new members of the credit union. Members are part owners of Focus Federal Credit Union and are treated like family. Members are encouraged to attend and to voice ideas or concerns by speaking up in meetings and voting for a board of directors. Banking at the same place where you’re a part owner provides more control over your account.

Focus Federal Credit Union spends a great amount of time serving our community. We partner with many non-profits and help provide financial education and other assistance where we are helpful. It is important that we are part of building a stronger community. And when you are a member, you are helping contribute to our community’s growth.

Resources a Member at Focus Credit Union Receive

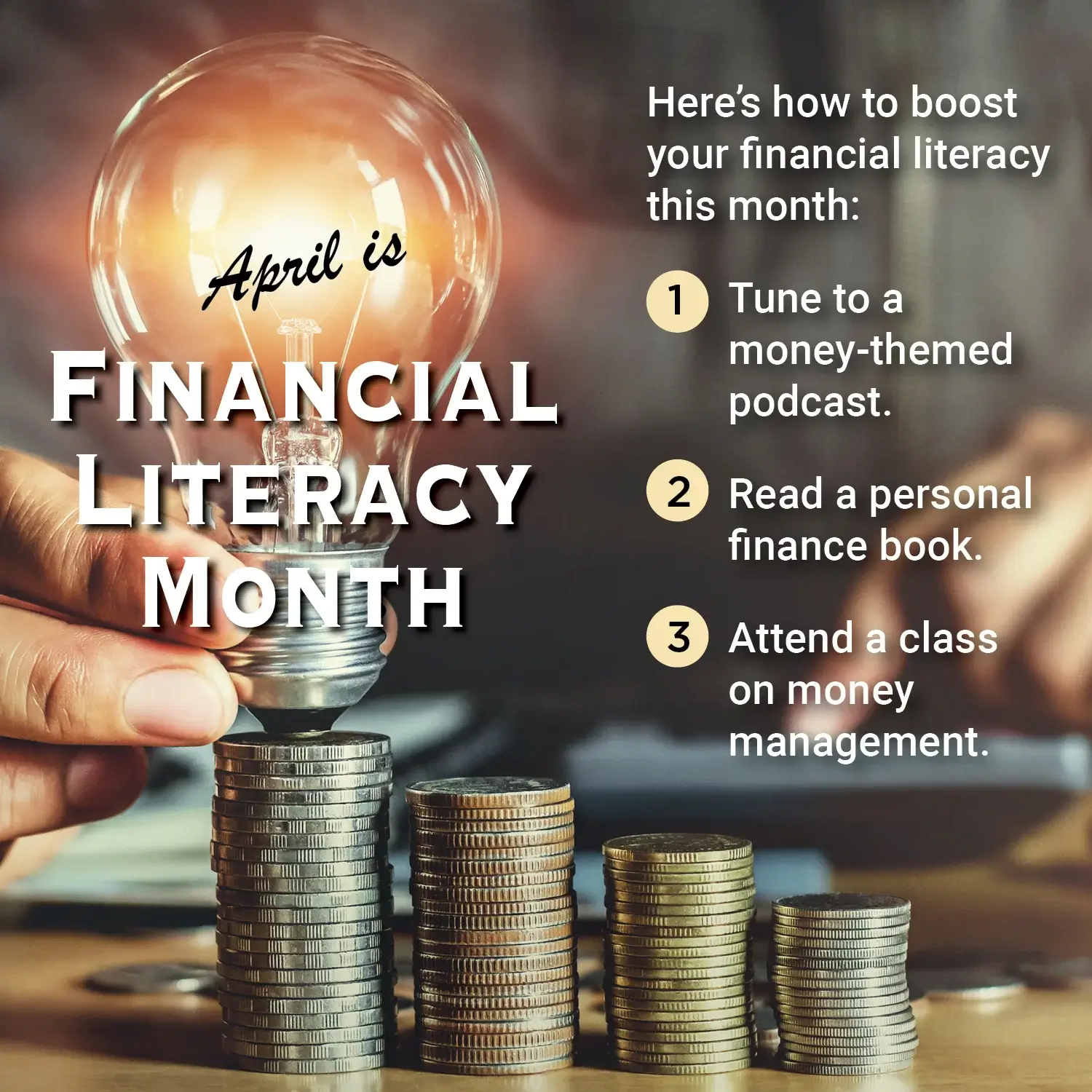

1. Education

Banks expect new customers to figure out how to operate a savings, checking, money market, retirement, etc., account to their advantage. Focus Federal doesn’t work that way. We want every member to thrive financially. This strengthens our credit union. Therefore, we offer blog posts and videos online on financial tips such as saving and budgeting. And one day, we will be offering our in-person classes again!

Additionally, we offer an educational resource called, Money School, and is open to anyone who wants to enroll. Money School consists of educational videos to teach you the financial know-how with a fun twist so members can balance their finances with ease. Furthermore, we offer in-person events and seminars to help members of the community learn about finance. We do this in our own office as well as through our partner agencies like the YWCA. Last, we offer a loan calculator to determine a monthly budget to pay off bills and make a decent living. We know when all members thrive at financing, we all reap the rewards.

2. Low Rates on Everything

Focus Federal Credit Union can afford low rates on loans, credit cards, and mortgages because we pass on the savings to our members. Some profits made at our institution return to our customers as low rates, making these financial perks affordable. Our MasterCard credit cards’ interest rate currently ranges between 8.99% and 17.99% APR*, most credit cards’ minimum interest rate is 17.99%. Banks charge high APR to offset risk in case new customers don’t pay on time. Focus Federal knows its members personally and financially and this direct relationship allows us to pass on savings.

All auto loans offered at Focus have a current interest rate that stops at 18%. Auto loans offer terms up to 10 years, and the interest rate on the lower end begins between 2.95% and 5.95%, depending on the term. And there are many types of car loans. Our other collateral loans, great for non-conventional items such as boats, farm equipment, RVs, and trailers, start at 4.95% APR*. Unsecured loans, with terms from 12 months to 60 months, always have competitive rates starting at 2.75% for storm shelter loans. A 10 or 15-year mortgage hovers around the 2% to 3% mark while a second mortgage offers 4%-6% interest for 60-180 months.

Lower rates means more money in your pocket and that is what we care about.

3. Generous Bank Account Interest

We know this is an unusual perk when you are used to traditional banking, and we are proud to be able to offer interest on checking accounts. We are registered as a non-profit, so after we use profits to lower your rates we take the remaining profits and return them to you as bank account interest. Banks can be stingy on interest-bearing checking and savings accounts, if they offer interest at all, but we are not.

Money holds equal weight to our members, so helping bank accounts grow helps our members and the community thrive, which benefits everyone. We cap our savings and checking account interest rates at .15%. Money market accounts will add more than .15% with higher bank balances. IRAs and certificates pay more interest to accounts that leave at least $1000 untouched for longer periods.

Do I Get Assistance with Financial Management?

Every member at Focus Credit Union gets access to a financial service representative. The representative learns about financial and personal aspirations about your finances and helps you work towards those aspirations. The representative helps you reach their goals by offering advice and suggestions that can lead to improvement of your financial situation. Your representative is available to answer any questions along your path. The representative cares about a member’s success with as much passion as the member.

Focus Federal strives to provide a warm, inviting environment where you come first because we know you’re more than a number. You’re family.

Contact Us and Become a Member Focus Credit Union

If you’re looking for a financial institution that operates differently from a bank, Focus Federal Credit Union is the answer. We place more emphasis on you by offering a personal touch most banking institutions cannot deliver. We aim to know our members by name, make eye contact, and shake their hands because our members matter. Contact us about becoming a member of Focus Federal Credit Union. We want to be on the sidelines cheering for you while you improve your finances, improve your credit, and reach your financial goals.

**Interest rates (APR = Annual Percentage Rate) determined by credit score. Normal credit union underwriting, terms and conditions apply. Rates subject to change.

Rate effective as of May 8, 2020