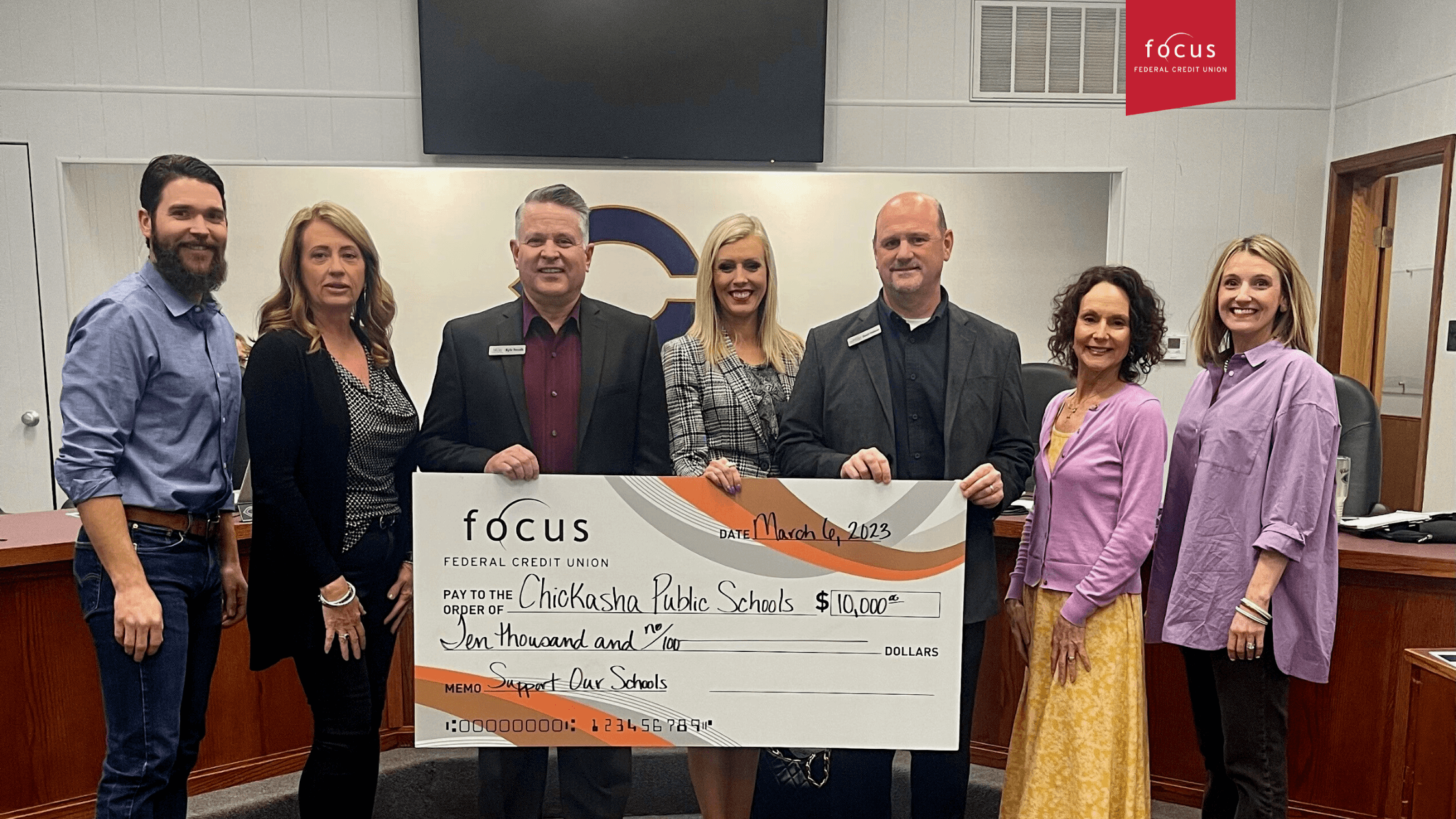

Focus Federal Donates to Chickasha Public Schools

Monday, Mar 20 2023

Program gives $10,000 to Chickasha Public Schools.

OKLAHOMA CITY – Focus Federal Credit Union announced the launch of the Support Our Schools Initiative in 2021. The program aims to provide financial support to the Chickasha Public Schools while saving community members money through competitive interest rate loans.

In March of 2023, Focus FCU donated $10,000 to Chickasha Public Schools after Focus FCU saved members $100,000 in loan interest.

“We’ve seen so many of our members already stepping up to provide much-needed support to our schools, and this is just an additional way we can help,” said Kyle Roush, Focus Federal Credit Union’s CEO. “To us, this program is a win-win. It helps our members save money and helps support our community schools with much-needed funding.”

We pride ourselves at Focus FCU on providing superior service, offering innovative products and being the financial institution that members choose first, use the most, and grow with throughout their lives.

“We are committed to helping our community grow by investing in our schools,” said Abby Cabello, Focus Federal Credit Union’s Director of Marketing. “Schools are our community’s heart and soul. We created this initiative to help them offset some of the budget challenges they face.

###

For more than 67 years, Focus Federal Credit Union has continued to deliver innovative products and services to our membership about all things financial by anticipating needs and providing exceptional member service. Learn more about our services, benefits, and community involvement at www.focusok.com.

Contact: Abby Cabello

405-230-1328 ext: 1106