How to Save an Emergency Fund

Thursday, Nov 3 2022

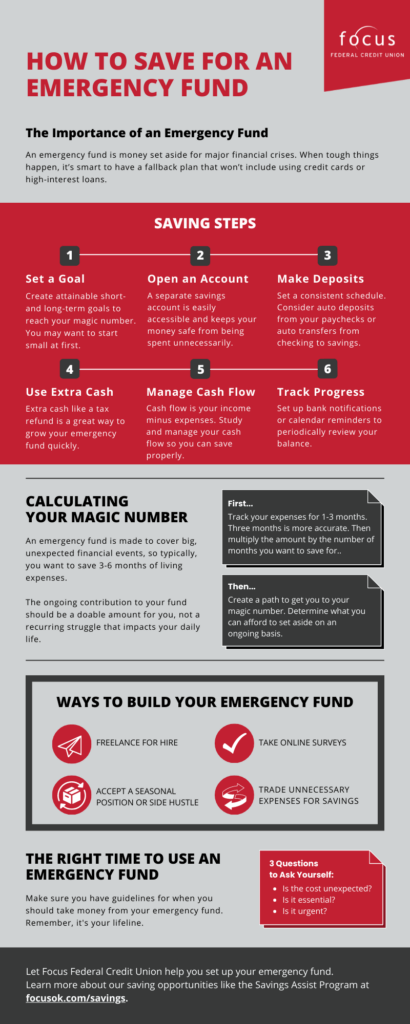

A fender bender, an unexpected bill, loss of income, or a new water heater — unplanned expenses feel like they hit at the worst times. Putting money aside for the unpredictable allows you to recover quicker and get back on track toward reaching your larger savings goals. But where do you put the money? What amount do you need to save? And where do you start? Knowing how to save an emergency fund is critical to avoiding debt.

What is an Emergency Fund?

When life presents an emergency, it threatens your financial well-being. You can quickly access cash from borrowing, but at what cost? Interest, fees, and penalties are drawbacks that can put you in debt. An emergency fund is money you can access to cover or offset unexpected expenses. It creates a financial buffer in a time of need without you relying on credit cards or high-interest loans.

Before you dip into your emergency fund, ask yourself:

- Is the Expense Unexpected? Car repairs, emergency medical expenses, or replacing the dishwasher are examples of emergency expenses. Back-to-school shopping, routine doctor visits, and regular home maintenance should be expected, budgeted, and planned for.

- Is It Essential? This question boils down to want vs. need. Needs are reliable transportation or paying a high tax bill. Wants are things like a vacation or the latest smartphone.

- Is It Urgent? Consider the time sensitivity of the expense. Does it impact your state of living if not paid? A sale at your favorite store isn’t critical, while a dental emergency is time sensitive.

How to Save an Emergency Fund

Everyone needs to save for the unexpected. But building an emergency fund takes discipline, time, and sacrifice. Knowing how to save an emergency fund is easier with a plan. To get started, follow the steps below.

Step 1: Set a Goal

Set yourself up for success by establishing short- and long-term goals. Set a specific and measurable plan to keep you motivated. Rather than aiming for three months’ worth of expenses, shoot for one month or two weeks initially. Build on your goals as you accumulate more cash in your fund.

Step 2: Make Consistent Contributions

Aim to set aside a specific amount each month, week, or paycheck. Set your initial contribution level at a relatively small amount to ensure success. The key is it needs to become a habit, not a recurring struggle. If you don’t have one already, create a budget and look for expenses you can afford to cut. Whatever money you save by trimming unnecessary items contributes to your emergency fund.

Step 3: Put Extra Cash in the Fund

There may be certain times during the year when you get an influx of money. Tax season is one time when many people can boost their emergency stash. When you file your taxes, consider having your refund deposited directly into your emergency account. Consider other times, like a holiday or birthday, when you receive a cash gift as a chance to put unexpected deposits in the fund.

Step 4: Open a Separate Account

Ensure funds are safe, accessible, and in a place where you’re not tempted to spend on non-emergencies. Set recurring transfers through your bank or credit union. If your employer offers direct deposit, there’s a good chance you can divide your paycheck between multiple accounts, so your monthly savings goal is taken care of without you having to do anything.

Step 5: Manage Your Cash Flow

Cash flow refers to your income minus expenses over a set period. It’s determining when your money is coming in and going out. Instead of focusing on a single month, track expenses for three months. You’ll have a more accurate picture of where your money is going. Don’t forget to budget yearly costs, such as insurance.

Step 6: Track Your Progress

Building up your emergency fund requires proper tracking. Check your savings regularly. Whether it’s an automatic notification, tracking app, or good old pencil and paper, keep a running total of your contributions. Seeing the sum will help track your progress and offer encouragement to keep going.

What is the Right Amount for You?

While your emergency fund size will vary depending on your monthly bills, income, and dependents, the general rule of thumb is the ability to cover three to six months of expenses with your emergency fund. This amount can seem overwhelming at first, but even a small amount can provide a little financial security, and putting away a specific amount each week or two allows you to build to your goal.

You may want to adjust the amount based on your family needs, job stability, or other factors. Start by estimating your necessary expenses, such as housing, food, health care, utilities, and transportation. Don’t include costs for anything you’d cut from your budgets, such as entertainment, dining out, vacations, and other non-essentials. If you’re in an industry where layoffs are common, your income isn’t steady, or you’re retired, it may warrant a larger emergency fund.

Let FFCU Help with Your Emergency Fund

A reserve fund can help you avoid relying on other forms of credit or loans when an emergency or unplanned expense happens — overwhelmed with how to save an emergency fund? Focus Federal can open a savings account and guide you through setting realistic goals. The critical part is getting started.