What ‘In the Heights’ Teaches about the Sum of Money Saved for the Future

Monday, Jun 28 2021

“Ninety-six Gs ain’t enough to retire.” The line from the “In the Heights” song “96,000” may tell us something about the sum of money we need saved for the future.

Maybe you have seen the movie, but if not there are still some lessons that we can learn about saving and when to start.

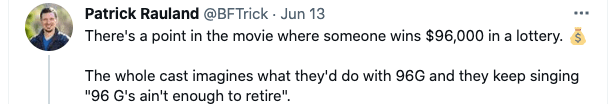

We saw this tweet thread from Patrick Rauland and it made us think about how our members could start planning their future.

There are indeed few places you could retire comfortably with $96,000. But is it true in the long term? Is $96,000 a big enough sum of money for the future?

Let’s say you win the lottery, like in “In the Heights.” You suddenly find yourself with $96,000 tomorrow. Yeet! What’s the smart thing to do?

Spend It Now?

“In the Heights” character Benny says he’d pay the entrance fee to business school with $96,000, then throw a block party. Vanessa would get a downtown NYC studio apartment and get out of East Harlem. Daniela says she’d spend her money on a new lease and head to Atlantic City, where she’ll drink Malibu Breeze.

Usnavy, the main character, says it isn’t enough to retire. At the same time he has very big plans for his future.

No spoilers here though, we aren’t going to tell you what happens!

It could be tempting to spend your 96Gs right away on something you want now –– like a Tesla Model S. Although a Tesla would take you to New Jersey –– with stops to charge it along the way — it won’t take you far financially. Neither will student loans after you graduate from business school or paying rent. It’s clear Daniela, Vanessa, and Benny are only considering the short term versus their sum of money saved for the future.

In a world full of credit cards and loans, it’s easy to overspend. Your favorite TikToker – like most Americans – probably isn’t using a tool to track their spending. More than 40% of Americans don’t even have $400 saved for emergencies. That’s concerning when the average insurance deductible is $1,000!

We pay the price for our desire to belong and fit in. Americans face highly intensified spending pressures, thanks to social media. We live in the wealthiest country in the world, yet half the population says they can’t afford everything they “really need.” It’s not just those who are low-income saying this. It’s an instant gratification and priority issue.

Investing – The Smart Decision

If you invest, you’re prioritizing your future. Investing $96,000 can fund your entire future. The saying “out of sight, out of mind,” applies to our savings, too. If you put your money somewhere inaccessible, the sum of money saved for the future increases significantly.

Young investors have the single most valuable financial resource on their side – time. Compound interest and dividend reinvestment are valuable methods of long-term wealth. Simple IRAs are an excellent investment choice.

Investing doesn’t mean that, when you reach retirement age, you’ll be able to purchase an expensive vehicle or check something else extravagant off your bucket list. Experts recommend that when you retire, you practice a safe withdrawal rate method to prevent worst-case scenarios. This method instructs retirees to take out a small percentage of their portfolio each year, typically 3% to 4%.

Do Some Math

Now, let’s get back to your 96G. If a 27-year-old Oklahoman has $96,000 to invest, you would have to pay $27,840 in estimated taxes, leaving you $68,160.

Experts estimate that, at age 27, every dollar you invest turns into almost $34. So, if you invest $63,000, your money will turn into more than $2.1 million.

At age 21, every dollar you invest turns into more than $76. Starting just six years earlier more than doubles your investment.

Ultimately, your most significant assets at a young age are time and compound interest. If you start investing in your 20s, you will have about 40 years to accumulate retirement savings. Your investments should focus on growth. It would be best if you put most or all of your long-term savings into equities, like stocks or stock mutual funds.

Regardless of when you start saving, you’ll want every penny you can muster after you stop working.

Focus Federal Can Help with the Sum of Money Saved for the Future

It may be bad news or good news for the “In the Heights” characters, but 96Gs is enough to retire… eventually. Ok, so you can’t get $96,000 and quit your job the same day. But it will create a nice retirement nest egg if you invest it properly.

So, instead of throwing that big block party, buying a new vehicle, or renting an apartment downtown, envision your dream for the future. A little grit can go a long way in increasing your sum of money saved for the future. Contact Focus Federal Credit Union for products to help you save.